Big Four auditing companies: PricewaterhouseCoopers, Deloitte, Ernst & Young, KPMG. Auditing and consulting services. The largest audit companies: an overview of the Russian market for auditing and consulting services The largest international audit companies

GC "Audit A" is one of the leading firms in the list of auditing companies in Moscow. In the rating (ranking) of the largest auditing and consulting groups in Russia according to Expert RA information for 2014, Audit A Group of Companies entered the TOP-20.

Our audit company constantly improves the quality of work and sets ambitious goals: to enter the top ten in the ranking of auditing companies in 2015, and in 2016 to become a member of the “Big Five” Russian auditing companies.

At GC “Audit A” you can order any audit: mandatory or initiative audit, including tax. If your business has a complex regional structure, we will take on the functions of the main one and control the quality of inspection of components (divisions).

When choosing a partner for conducting an audit, it is worth take it seriously. This determines what will be obtained in the end: a qualitative analysis of activities, accounting and reporting or an audit report that is useless for business. Experts recommend contacting a top auditing company that developed an image, experience, professionalism.

“Russian Big Four/Six” auditing companies: where to look

Today, the level of competence of Russian auditors can be judged based on their position in the rating of auditing companies. Since Russian business activity concentrated in Moscow, then you should look for national audit stars here, among the best audit companies in Moscow and the Moscow region.

Ratings of large auditing companies, incl. Moscow, since 1997, published annually by the Expert RA agency, accredited by the Ministry of Finance of the Russian Federation. It is precisely the place in the ranking that is currently objective and independent confirmation of market positions. The rating of auditing companies for 2015 is expected to appear on the agency’s website during March 2016. The top/rating of auditing companies 2016 will be ready, accordingly, in March 2017.

Advantages of cooperation with Audit A Group of Companies

Our company is on the list of the largest auditing companies in Moscow. The competence of the specialists of the Audit A Group of Companies is confirmed by reviews from regular clients and highest score Moscow Audit Chamber.

We do not rest on our laurels, we are constantly improving our professionalism, and we aim to deservedly get into the ranking of the best auditing companies in Moscow for 2015. The achievable goal is excellent stimulus to move forward.

Our audit company operates in Moscow and the Moscow region and offers auditing at an affordable price. We can help you increase business competitiveness and make effective anti-crisis management decisions.

Dear Colleagues!

Ensuring high quality of audit services provided based on compliance with national auditing rules, improving technology and organization of auditing contribute to a high level of service and meeting the needs of users of financial statements.

Based on the information received by the editors of the “Chief Accountant” magazine, a rating of organizations providing audit services was formed based on the results of work for 2016.

The given data on the volume of revenue for services provided for 2016 indicate a stable rating of leading audit companies. Among the leaders in the rating are the following companies:

Grant Thornton LLC - first place;

FBK-Bel LLC - second place;

Baker Tilly Bel LLC - third place.

Over the course of 23 years of operation, Grant Thornton LLC has acquired a reputation as a reliable partner and one of the leaders in the audit services market. It is a member of the International Network of Audit Organizations Grant Thornton International Ltd (London, UK). The company continues to strengthen its position in the audit services market, helps dynamically developing companies unlock their internal potential, and provides audit and professional services in accordance with national and international standards in various sectors of the economy.

The company is accredited for projects financed by the European Bank for Reconstruction and Development, the World Bank, and provides services to other international financial institutions.

A consistently successful audit organization in the Republic of Belarus is FBK-Bel LLC, a member of the International Audit Network PKF International (London, UK). The company has unique practical experience in auditing financial statements prepared in accordance with IFRS requirements at enterprises and organizations of various forms of ownership and in various areas of the economy of the Republic of Belarus. FBK-Bel LLC takes part in projects financed by the European Bank for Reconstruction and Development, the World Bank, the Nordic Investment Bank and other foreign organizations.

The company operates a system of comprehensive consulting support in the field of implementation and application of IFRS, including the provision of the necessary services associated with this process for assessing the value of assets based on the IFRS methodology.

Baker Tilly Bel LLC is a member of one of the largest international audit networks - Baker Tilly International (London, UK). The company has significant experience in implementing projects in the field of IFRS both for individual companies and for holding structures in various sectors of the economy. Baker Tilly Bel LLC offers a full range of services in the field of auditing, consulting, as well as accounting and tax accounting for foreign enterprises.

The presented data from the rating of the audit services market indicate that a number of audit organizations are quite actively improving their status by increasing the volume of services provided and attracting new clients. Among these companies, we highlight the following organizations:

ODO "ProfAuditConsult" - revenue growth was ensured by more than 2 times compared to 2015;

LLC "AuditKomServis" - increase in the volume of services provided compared to 2015 by 77.7%;

LLC "Audit and Law" - growth rate of audit services - 52.6%;

ODO "ClassAudit" - revenue increased by 50.6% compared to 2015;

LLC "Audit Center "Erudite" - revenue growth compared to 2015 - 47.5%;

FinExpertiza-Bel LLC - revenue growth compared to 2015 - 46.5%.

Key positions in the audit services market are also occupied by other organizations participating in the 2016 rating.

Congratulations to all participants in the ranking! We wish you good luck in your necessary and complex work, so that compliance with the basic principles of auditing - independence, confidentiality, professional competence, ethical behavior - serves as the basis for the good reputation of our organizations in the Belarusian and foreign audit services market.

We invite auditors to cooperate as authors of the “Chief Accountant” magazine. We look forward to your suggestions for improving the procedure for rating audit organizations.

Vartan Khanferyan

The next, 23rd, annual release of rankings of the largest Russian audit organizations and groups, compiled by the agencyRAEX(RAEX-Analytics), revealed a decrease in income in this service sector. The resumption of growth here is closely related to the state of the economy as a whole, an increase in the level of technology in the industry, and, in the medium term, to the impact of planned regulatory reforms.

The 2017 ranking, like the previous one, was created on the basis of an updated methodology (see the reference “How We Believed”), which aims to increase the objectivity and reliability of the information taken into account when compiling the lists, as well as to separate as clearly as possible the core activities of participants from the numerous side services. This approach, formed through active interaction with the audit community itself, is bearing fruit. Evidence of the support of the trade union community for the updated methodology can be considered that a number of old-timers of this market took part in the current lists for the first time or after a long break, for example, the companies Inaudit, MKD, MKPTSN and others, as well as the fact that All Big Four companies without exception provided information for the ranking of auditing organizations. , a number of which were previously included in the lists only as groups.

Angle of incidence

The total income of the largest audit organizations decreased by 5% at the end of 2017, amounting to 35.717 billion rubles (see table “List of the largest Russian audit organizations (subjects of audit activity) at the end of 2017”). A year earlier, we recall, there was an increase of 6%. The most noticeable contribution to the final disappointing result was made by the top participants in the list: although only a third of the ranking audit organizations (42 companies) ended the year with a negative result in revenue, their share accounted for 70% of the total figure. There were slightly fewer such companies on the 2016 list (36), but their share accounted for only 11% of total revenue.

The drop in demand observed in the ranking affected the absolute market leaders – the Big Four. The reason for this was the reorientation of a number of large clients to companies perceived as unconditionally Russian, plus increasing price competition in the market.

However, the overall negative result for the total revenue of audit organizations is the “average temperature for the hospital,” which aggregates multidirectional trends in individual market sectors. If you look at them separately, the picture turns out to be less clear, even motley.

Revenues in the largest sector by size – mandatory audits -- at the end of 2017 decreased by 5.9% (from 16.646 billion rubles a year earlier to 15.664 billion rubles). The desire to save money on a procedure imposed by law leads not only to the migration of clients from top companies, whose services cannot be cheap, but at the same time puts pressure on the general level of average market prices - the very opportunity to pay less for obtaining an audit report gives the client additional leverage even on the largest audit companies. Victoria Salamatina, Energy Consulting, head of the international network HLB International in Russia, explains: “The pressure of the low price factor has not been overcome in procurement procedures in which the selection of a supplier - an audit organization - takes place. Audit companies that do not want to accept the deterioration in the quality of their work are forced to minimize income, and sometimes even actually pay for maintaining a decent level of services at their own expense.” Svetlana Romanova, General Director and Managing Partner of Nexia Pacioli, adds: “There are tenders in which we do not participate, because we cannot guarantee the proper quality of services at such low prices. Dumping in auditing still persists, but the reform is designed to eliminate this, and the prerequisites for this are being observed. There is hope for the establishment of healthy competition between equal firms - market leaders."

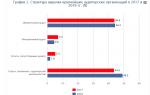

A noticeable decrease in indicators was shown by the segment designated in the reporting as “ other services related to auditing activities" -- Most of it is consulting. It brought list participants 15.5% less than a year ago: 18.452 and 15.589 billion rubles, respectively (see chart 1). The negative dynamics in this type of service is associated with a number of factors.

Firstly, in connection with the implementation of International Standards on Auditing (ISA) in 2017, part of the income that in 2016 was entered in the column “Other services related to auditing activities” is now recorded in the lines “Services related to auditing” or “ Initiative audit". As a result, both of these sectors grew in 2017. So, services related to audit , increased by a fantastic 170.5% and reached 1.903 billion rubles (versus 703.6 million rubles a year earlier; see charts 2 and 3). At the same time, income from auditing in the ranking of organizations for the year increased by 5.5% and amounted to 20.128 billion rubles, while from consulting, on the contrary, decreased by more than 15 percent - to 15.589 billion rubles. The income from proactive audits – from 1.735 billion rubles in 2016 to 2.561 billion rubles in 2017: the increase was 47.6%. (In parentheses, we note that the achievements of these two sectors made it possible to bring the total audit indicator, which is not limited to mandatory inspections, into the positive zone).

Let us return, however, to the consulting indicators. The second reason for the reduction in income from it, obviously, is economic turbulence - the customer saves as best he can, including by doing part of the work on his own. Nina Kozlova, managing partner of the international audit and consulting network FinExpertiza, gives an example: “The decrease in consulting volumes in 2017 was due to a reduction in volumes and a decrease in the cost of transfer pricing projects. In addition, the number of IFRS audit projects has increased, with a simultaneous decrease in demand for services for transforming IFRS reporting - companies are increasing their own competencies in this area.”

And finally, thirdly, in a number of cases, consulting projects of audit organizations can be transferred to affiliated consulting companies, due to the latter having the appropriate specialization.

In a somewhat less pronounced form, the trends arising from the analysis of the ranking of audit organizations also follow from the results of the ranking of the largest audit groups and networks (see table “List of the largest Russian audit groups and networks, based on the results of 2017”). Their total revenue in 2017 amounted to 66.4 billion rubles, having decreased by 1% over the year. At the same time, total income from consulting fell by 2% 1, while from auditing, albeit slightly - by 0.8% - increased.

Among consulting practices, the largest portion of revenue in 2017 came from services financial management – 3.447 billion rubles, or 19% of the total revenue of the ranking participants (hereinafter, the structure of revenue from consulting is given without data from the Big Four due to the lack of a detailed revenue structure for ranking purposes). Over the year, this sector grew by 12%, primarily due to demand for accounting outsourcing. “The main driver for the development of outsourcing is savings in service costs, which can reach 80% compared to the costs of maintaining our own accounting department,” shares his opinion Ruslan Rumyantsev, partner of CBS group.

Services tax and legal consulting in total, the ranking participants brought 2.636 billion rubles (14% of the total structure), decreasing by 2.6% over the year. The comparative stability of demand for tax consulting and legal services explains Marina Rizvanova, General Director of the Ural Union audit group: “On the one hand, the state continues to strengthen tax administration, and on the other, the demand for auditor services is increasing due to the “digitalization” of tax authorities. It has led to increased demands for the submission of documents on various control ratios, which must be quickly and skillfully analyzed for legality in order to answer them correctly. The cost of a mistake has increased today, since, for example, penalties have already been introduced at a double rate from the second month of arrears.”

According to Victoria Salamatina, the demand for tax advice is also due to legislative innovations, which are associated with the implementation of the requirements of the action plan to counter the erosion of the tax base, as well as the withdrawal of profits from taxation (BEPS - Action Plan on Base Erosion and Profit): “Taxation and reporting in the presence of controlled foreign companies, the expansion and improvement of reporting by international groups of companies on intra-group transactions, a change in focus from formal compliance with tax residency criteria to the actual right to income and place of activity - all this has changed and will continue to change approaches to international tax planning, the application of agreements on the avoidance of double taxation taxation."

Another 2.335 billion rubles, or 9%, in 2017 amounted to total income from appraisal activities , which decreased by almost 18% over the year. Services traditionally have a significant share IT consulting : 2.946 billion rubles (16%) - a decrease of 10% over the year. “In 2017, we observed demand for services for the implementation of ERP solutions, including large complex business transformation programs based on SAP technologies. This confirms the current shortage of SAP specialists in ERP functionality in the market. At the same time, there is a clear trend towards the deployment of projects and the creation of large clients’ own digital laboratories to promote solutions for digital transformation and data governance. As before, the drivers of these topics are vendors and consulting companies that are actively offering new solutions and services in the field of business digitalization,” comments Andrey Yakimenko, senior BDO Unicon Business Solutions.

When forecasting trends in the consulting part of the business of audit organizations, market participants are quite cautious, although in general they are inclined to optimistic assessments. “The fundamental drivers of demand for consulting services are investment activity and strategic development and management tasks. And although we are currently seeing a decline in these areas, more and more consulting tasks are emerging related to increasing the transparency of business processes, automation and a risk-based approach - this is due to the general trend of increasing business control and responsibility in many aspects,” says Vera Konsetova, General Director of the company "AFK-Audit". A Vladislav Pogulyaev, General Director of BDO Unicon JSC, adds optimism to the identified market factors due to the introduction of new technologies: “Their influence on the audit can significantly increase its efficiency, reduce labor costs, etc. For example, already established statistical computer data processing and electronic work documentation tools are complemented by data analytics technologies. They help to abandon the selective approach in favor of analyzing the entire array of data of the audited companies and searching for logical relationships, as well as identifying anomalies that significantly distort the financial statements. Despite the fact that Russian audit lags behind many business sectors in terms of the speed of transformation, the largest Russian audit companies are actively introducing IT technologies, integrating them into the Russian legal framework and are ready to offer high-tech solutions to their clients.”

The impact of digitalization of business processes on customer needs is noted by Alexander Ivlev, EY Managing Partner for Russia: “Companies are forced to adapt to this. Services for creating a digital strategy, process robotization, predictive analytics, and cybersecurity are becoming increasingly in demand among our clients. Further developments in digital technology require us to develop innovative approaches to the audit process to provide confidence and trust in the capital markets. As companies also seriously consider how to integrate new technologies, such as blockchain, into their financial processes, we are applying innovative solutions to the audit process. For example, just recently, we announced the launch of a pilot version of EY Blockchain Analyzer, a tool for auditing blockchain solutions that significantly expands the capabilities of verifying transactions with cryptocurrencies. This technology is designed to support EY audit teams in their audits of cryptocurrency companies and will lay the foundation for automated testing of assets, liabilities, capital and smart contracts using blockchain technology as its use in companies expands.”

Project of the future

In 2017, the audit services market was on the verge of significant changes associated with the transformation of the system of regulation and supervision in the industry. And although final decisions have yet to be made, the general outline of the reforms has already been formed. Thus, we can say that in the near future the powers of the audit market regulator will be transferred from the Ministry of Finance to the Bank of Russia, which wants to cleanse the audit community of traders in the certifying seal. The Central Bank directly encountered the latter during the clearing of the banking market, when it turned out that some of the banks that had been deprived of their licenses or were subject to reorganization, on paper - according to the statements certified by auditors - looked quite “white and fluffy”. Victoria Salamatina explains the prerequisites for the reform: “The reason is the negative financial consequences of the increasing frequency of revocations of licenses of credit institutions, whose statements, being certified by an auditor, contained indicators that differed from the data during subsequent assessment by the Central Bank. In order to control audits carried out in relation to the reporting of socially significant organizations (mainly the financial sector), the state decided that it was the Central Bank that should regulate and control audits.” Sergey Nikiforov, General Director of the FBK-Povolzhye company, Chairman of the public organization National Union of Auditors, adds: “In recent years, the functioning regulator of auditing activities [the Russian Ministry of Finance] has ignored the increase in the share of audit entities that only formally fall under the definition of an audit organization, and has not addressed attention to the fact that existing criteria stimulated the majority of organizations subject to mandatory audit to either evade or pretend to carry it out.”

Throughout 2017, the Central Bank, together with the trade union community, worked on a draft package of amendments to the Law “On Auditing”, which has already passed the first reading in the State Duma and will soon pass the second. “The opinion of the audit community was listened to. Discussions of the bill took place in many regions with representatives of SROs and the business community. The problems of the industry were discussed at various platforms, including now when the bill was adopted at the expert council of the State Duma, where regional auditors are also invited,” says Egor Churin, General Director of Invest-Audit LLC, Chairman of the Statutory Audit Commission of the Ural Branch of the SRO Russian Union of Auditors.

The draft legislative amendments can be divided into the following main groups. Firstly, it is expected to narrow the range of companies subject to mandatory audit. Secondly, the requirements for entering the audit market will be tightened. Thirdly, it is planned to strengthen the requirements for certification of statements of banks and other organizations supervised by the Central Bank. Fourthly, it will become more difficult for auditors to certify the reports of socially significant economic entities. Fifthly, it is planned to introduce a qualification and reputational qualification for organizations included in the Central Bank register, as well as a rotation of auditors, limiting the period of work with one client to seven years. Finally, the model of self-regulation in the financial market must change, increasing the responsibility of SROs.

If the law is adopted, and it is recognized by the market as almost inevitable (the only question is the timing and nuances of the wording), one of the most important consequences of the reform will be a reduction in the number of subjects and objects of audit activity. Elena Loss, President of the RSM RUS company, believes that “the reform may lead to a reduction in the number of small audit companies. As a result of such a reduction, the cost of audits for large companies, in particular, the mandatory audit of the OHSS, may increase due to a decrease in dumping. In addition, the departure from the audit market of small companies with a staff of three to four employees will improve the quality of audits.”

“The introduction of a requirement for the number of auditors with a single certificate for audit companies has already led to a market race for specialists - highly qualified auditors. At the same time, their implementation of projects, in addition to improving the quality of services, may cause an increase in the cost of the audit,” adds Elena Laskeeva, Development Director of JSC Audit and Consulting Firm MIAN.

Vera Konsetova also predicts a reduction in the number of audit companies, however, according to her, after stabilization, the volume of revenue in the market should recover due to new approaches to pricing for services. “Also, the upcoming reform in auditing will help increase the prestige of the profession, which, in the medium term, can eliminate the shortage of qualified personnel,” she believes.

More cautious in assessing the possible impact on the market Oleg Goshchansky, Chairman of the Board and Managing Partner of KPMG in Russia and the CIS: “With regard to the volume of the audit market, I would indicate two vectors, which are often opposite. On the one hand, the market will shrink because the list of companies that will be subject to the mandatory audit services market is shrinking. On the other hand, pricing in the audit market is at such a depressing level that all measures to improve the quality of audits will lead to the fact that these prices will no longer allow audit companies to maintain the normal quality and level of services. This should inevitably lead to a change in pricing policy and a reduction in dumping in the audit of socially significant organizations. “I hope this will lead to a recovery in the audit market in terms of revenue, because quality audits don’t come cheap.”

1 . For comparable indicators excluding the Big Four companies.

Over the past 5 years alone, the domestic market for auditing and consulting services has doubled. The main customers of auditing companies' services are large businesses and public sector enterprises.

The most reputable audit companies in Russia, as a rule, are subsidiaries of international institutions. Today we bring to your attention rating of the largest auditing companies in the Russian Federation. The rating participants are ranked by annual revenue.

10. ACG “BUSINESS PROFILE” (GGI)

The auditing and consulting group “BUSINESS PROFILE” has consistently occupied a leading position in the Russian market since 1995. AKG is a partner of the international audit association Geneva Group International (GGI).

The auditing and consulting group “BUSINESS PROFILE” has consistently occupied a leading position in the Russian market since 1995. AKG is a partner of the international audit association Geneva Group International (GGI).

9. RSM "Top-Audit"

At the end of 2013, the company split, and today the auditing company RSM Rus and the consulting company AKF Top-Audit operate on the market. Among the clients of RSM Top-Audit are such giants as JSC Federal Grid Company UES, FSUE Russian Post, JSC Gazprom, JSC Aeroflot, JSC MTS, JSC Rosneft, JSC Russian Railways ", OJSC "Sberbank of Russia".

At the end of 2013, the company split, and today the auditing company RSM Rus and the consulting company AKF Top-Audit operate on the market. Among the clients of RSM Top-Audit are such giants as JSC Federal Grid Company UES, FSUE Russian Post, JSC Gazprom, JSC Aeroflot, JSC MTS, JSC Rosneft, JSC Russian Railways ", OJSC "Sberbank of Russia".

8. ACG “Development of business systems”

The company was awarded the national prize “For Contribution to the Economic Development of Russia”, and is also among the “1000 best enterprises in Russia”. RBS is part of the international network Crowe Horwath International with an annual turnover of about $3.2 billion. The network includes 558 companies from 120 countries.

The company was awarded the national prize “For Contribution to the Economic Development of Russia”, and is also among the “1000 best enterprises in Russia”. RBS is part of the international network Crowe Horwath International with an annual turnover of about $3.2 billion. The network includes 558 companies from 120 countries.

7. “2K Audit - Business Consulting/Morison International”

The company is a member of the international association of independent consultants and auditors Morison International. The association ranks 4th in Europe in terms of total revenue. There are 8 branches of the company operating in Russia.

6. Energy Consulting

This group of companies was founded in 2001. And since 2013, Energy Consulting has been the main partner of the international network of independent auditing and consulting companies HLB International. Among the clients of Energy Consulting are Tatneft, RAO UES of Russia, Gazprom, Mechel, LUKOIL, SIBUR, AVTOVAZ, Sberbank of Russia, Uralsib, Alfa-Bank.

5. "Intercom-Audit"

The company was founded in 1993. Since 1996, Intercom-Audit has been a member of BKR International - the World Association of Accounting and Consulting Firms. The company's branch network covers 150 cities in Russia and the CIS. About 20 thousand clients use Intercom-Audit services.

4. BDO

The group company is a member of “the BDO network” - an international organization of independent auditing and consulting companies, which is fifth in the world in terms of total revenue. “the BDO network” unites about 55 thousand employees in 139 countries.

3. "FinExpertiza"

Since 2004, the group company has been the exclusive representative in the Russian Federation - the international association of independent auditing and accounting companies CPA Associates International. FinExpertiza's clients are Russian Railways OJSC, Rosneft, ROSENERGOBANK.

2. KPMG

KPMG has been operating in the Russian market since 1990. Since 2009, the group of companies has been part of KPMG Europe LLP. In 2013, KPMG was recognized as the best company providing tax services in Russia.

1. PricewaterhouseCoopers Russia B.V.

The Russian representative office of the world's most famous auditing company, PricewaterhouseCoopers, employs more than 1,380 accountants and auditors, about 550 tax and legal consultants, as well as 350 consultants on investment issues, services in the field of financial and economic activities and corporate finance.